A Refresher for National

Credit Education Month

By Mark Buonaugurio

Is debt a good thing or a bad thing? Different people will give different answers. Fire can be used to make a delicious meal; it can also reduce a home to ashes. So, too, the prudent use of debt can help achieve one’s dreams, while the excessive use of debt can lead to a financial nightmare.

March is National Credit Education Month, and that makes this a good time to learn or refresh some basics about debt and credit. First things first: what is the difference between debt and credit? Debt is a financial obligation one assumes from borrowing funds from another party. That implies the obligation to repay those funds at a later date, typically with additional payments (interest) added to the repayment of the original loan amount. Credit, by comparison, refers to one’s trustworthiness to manage and repay their debts. Someone who is judged likely to repay his debt will have “good credit” and will be more likely to receive a loan when wanted, and on more favorable terms, than someone who is considered a poor risk – a “poor credit.”

This latter idea gives rise to the use of credit scores, which is a means of rating individuals’ trustworthiness in borrowing and repaying debt. Their credit scores, typically measured by one of three consumer credit monitoring agencies (Equifax, TransUnion and Experian) are developed and maintained based on individuals’ actual history in managing their debt. This credit history develops from their use of credit cards, mortgage loans, car loans, etc. Faithfully meeting one’s minimum monthly payments, and reducing debt over time, results in a good credit score. Conversely, missed or late payments, and growing debt balances over time, result in poor credit scores.

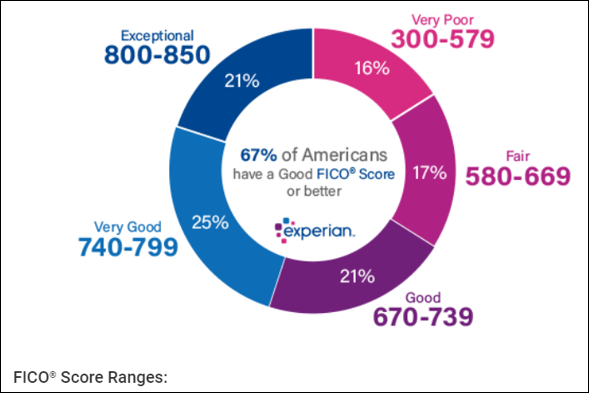

Typically, credit scores are measured on a scale that ranges from 300 to 850 points. According to Experian, the best loan candidates (very good and exceptional) have credit scores between 740 and 850. Credit scores below 669 represent very poor or fair credits. Banks, auto dealers and credit card companies, to name a few, all use credit scores in deciding whether to extend loans to customers, and on what terms.

For someone who hopes to borrow, there is clearly value in maintaining a good credit score. But is building a credit history and a credit score important for someone who thinks that debt is a danger to be avoided? Actually, yes. Credit cards have become an almost essential financial tool in the modern economy. They can be used to facilitate transactions at stores and gas stations, and they are typically needed to reserve a room at a hotel. It is also not uncommon for prospective employers to review the credit scores of job candidates to better estimate their reliability as a potential employee. For all these reasons, having a credit history is a very practical thing, but it can be difficult to evaluate one’s credit worthiness if there is no credit history to review.

There is certainly virtue and financial freedom in avoiding the excessive use of debt. Learning to live within our means and being realistic in our spending habits can help us avoid personal crises during the best of times, not to mention periods of recession or unexpected emergencies. These habits are also keys to financial success in planning for a stress-free retirement.

This doesn’t mean we should avoid debt at all costs. Borrowing can be a particularly helpful tool when we use it to smooth out gaps in our cash flow, as long as we also keep our repayment obligations in line with our regular income and long-term earnings. For example, most people would have a hard time paying cash for a house. Saving enough funds, while also paying a monthly rent, can make that a daunting, if not impossible, task. But the prudent use of a mortgage loan can put the “American dream” of home ownership into reach for many people. Yet, the financial crisis of 2007-2009 proved that irresponsible lending practices by mortgage companies, combined with speculative and excessive borrowing by home buyers beyond their ability to repay, was a true recipe for disaster.

Some debts are more justifiable than others. Borrowing to purchase appreciating assets (homes, businesses and other investments) is better than borrowing to buy depreciating assets like cars and consumer goods. Balances on credit cards are almost always to be avoided, though regular use of credit cards for transactions can be helpful. Borrowing to pay tuition, though very common, has become a potential source of trouble in recent years. It is always wise to compare the future payoff of an investment (even an education) to the cost of financing it. Similarly, it’s always best to borrow and spend within one’s means, so that the credit established will always be there when needed.

Mark Buonaugurio is a Senior Wealth Advisor at Canandaigua National Bank & Trust.

Sharing is caring!